Pyramid Schemes vs Ponzi Schemes: The Fraudulent Ventures, and how they work.

Pyramid schemes and Ponzi schemes have been fostered globally since the early 1920s. Both schemes have illegal elements and have ultimately misappropriated billions of dollars collectively since the beginning. If you’re ever approached by someone promising big returns for little effort, be wary and conduct your own research first.

Pyramid schemes are a type of fraudulent and fragile business model that has been around for decades, yet they continue to lure in unsuspecting victims with promises of quick riches and easy money. These schemes can result in financial loss for participants. They primarily rely on recruiting new members to make money, rather than selling actual products or services. The people at the top of the pyramid make the most money, while those at the bottom often lose their investment.

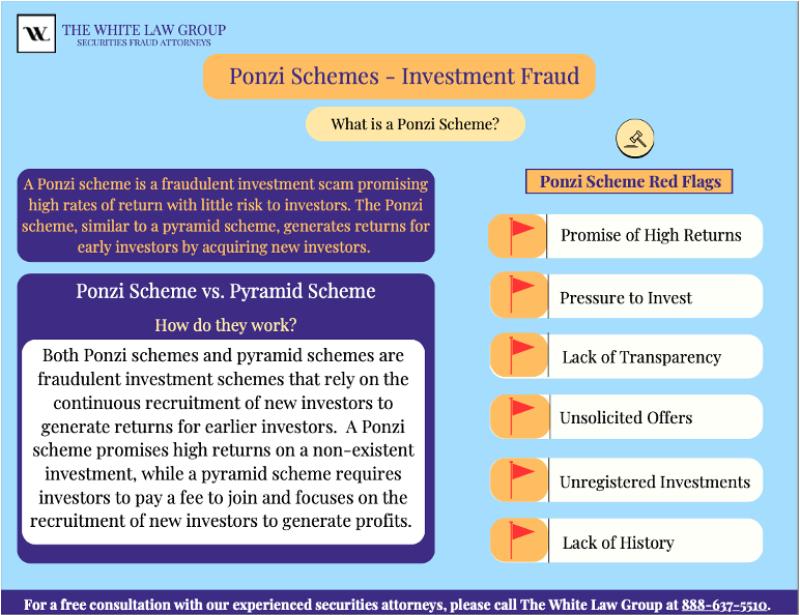

Ponzi schemes, a type of investment fraud, are similar to pyramid schemes, but they work a little differently. In a Ponzi scheme, a person running the scheme promises to invest money in something that will give them a high return. However, instead of actually investing the money, the person running the scheme uses the money from new investors to pay off earlier investors. This creates the illusion of profitable investment, but in reality, the scheme is unsustainable and eventually collapses, leaving the investor with empty pockets.

It’s important to understand how these schemes work, so you never find yourself caught up in these fraudulent models. Recognizing the primary details of a pyramid or Ponzi scheme is critical and can save you and your finances from dismantling. The way they work is simple. Pyramid schemes are based on promising large returns investments if they recruit others to invest in the business. One of the biggest issues with pyramid schemes is that they are often disguised as legitimate business opportunities. They may be marketed as multi-level marketing (MLM) or direct selling opportunities, however there is a distinct difference between a legitimate MLM, and a company disguised as an MLM.

The key difference is participants in a legitimate MLM make money by actually selling a product or service, rather than recruiting new members. One example of a pyramid scheme is the “airplane game.” In this scheme, people are invited to join a group and pay a fee to enter. They are then encouraged to recruit others to join the group as well and pay a fee. The person who recruited them gets a cut of their fee, and so on. The idea is that as the pyramid grows, people eventually start making money. However, in reality, only the people at the top of the pyramid make any money, while those at the bottom lose their investment. Eventually the pyramid collapses when there are no new members to recruit.

In a Ponzi scheme, the strategy is usually presented as a legitimate investment opportunity, and the person running their scheme may even offer false financial reports to make it seem like the investment is doing well. However, in reality the money is not being invested and the returns are being paid out of the money from new investors. One of the most famous examples of a Ponzi scheme is the one that was run by Bernie Madoff. Madoff promised high returns to investors and used the money from new investors to pay off earlier investors. He was able to keep the scheme going for many years by using false financial reports to make the investment appear to be thriving and legitimate. However, the scheme eventually failed and collapsed leaving people with detrimental losses, and a record $65 billion dollars stolen.

These schemes are often targeted at vulnerable populations such as elderly or low-income individuals. These groups may be more likely to fall for the promises of quick and easy riches. In both pyramid schemes and Ponzi schemes, eventually they collapse. When there are no new investors or recruiters to pay off earlier investors or recruiters to pay a fee to begin at the business, everyone ends up losing their money. If you are considering investing in a business opportunity, it is important to do your research and make sure it is a legitimate business and opportunity. Look for a business with a proven track record, exercise transparency about business practices, and a record of admirable revenue slopes. Keep in mind that if something seems too good to be true, it probably is!

If you have suffered investment losses in a Ponzi scheme or other fraudulent investment, a securities attorneys may be able to help you. When brokers violate securities laws, such as making unsuitable investments, the brokerage firm they are working with may be liable for investment losses through FINRA Arbitration. If your broker has defrauded you, you may be able to file a claim with FINRA to seek resolution through arbitration. FINRA arbitration can be a complex and technical process, and having an experienced attorney who is knowledgeable about securities law can greatly increase your chances of success. A securities attorney can help you with many aspects of the arbitration process including evaluating the merits of your claim and determining whether you have a strong case for arbitration.

More to Read:

Previous Posts: